Underrated Ideas Of Info About How To Claim Earned Income Credit

As an example, if you spent $6,000 on education in 2023, you can claim 20%, or $1,200.

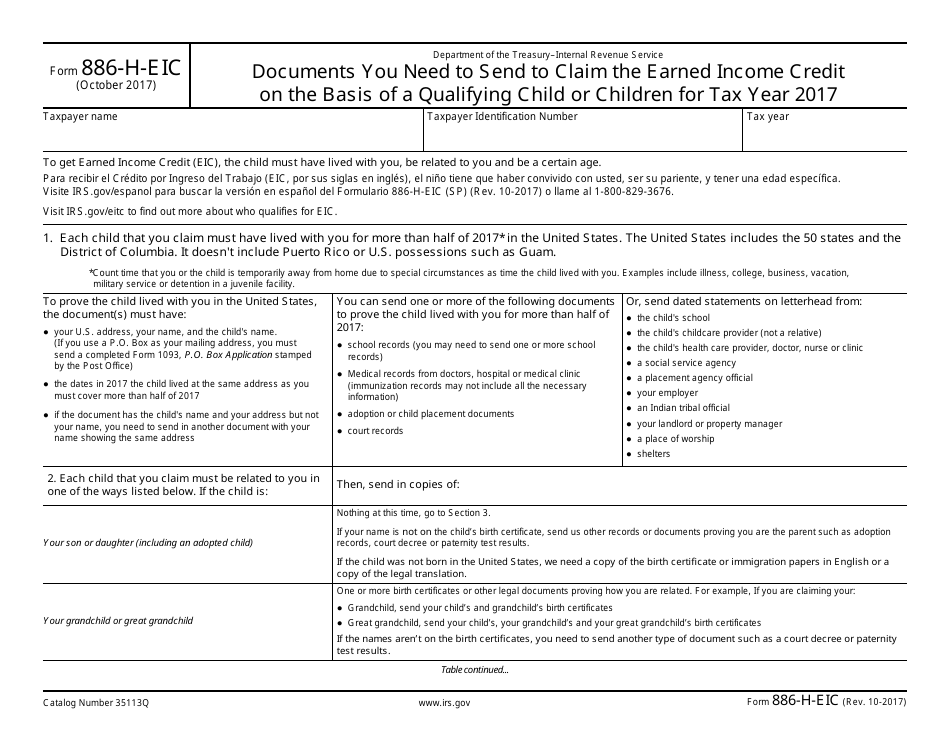

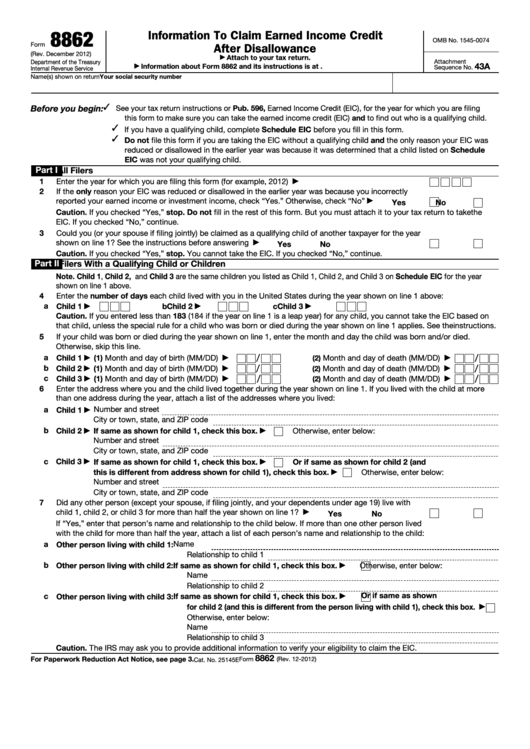

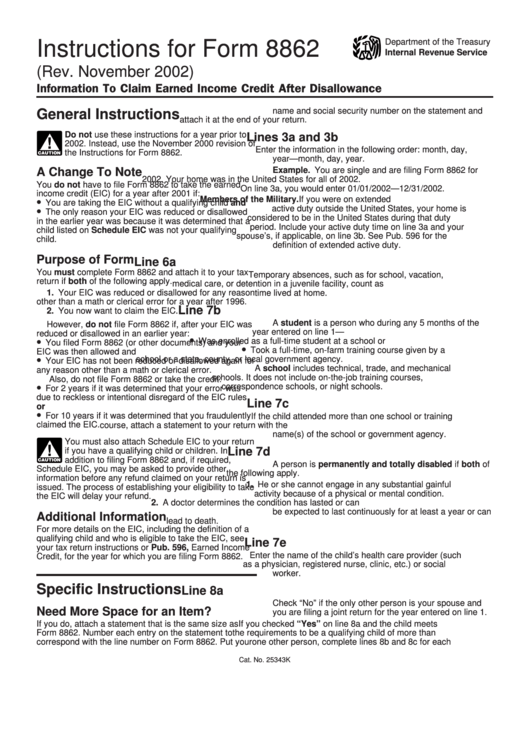

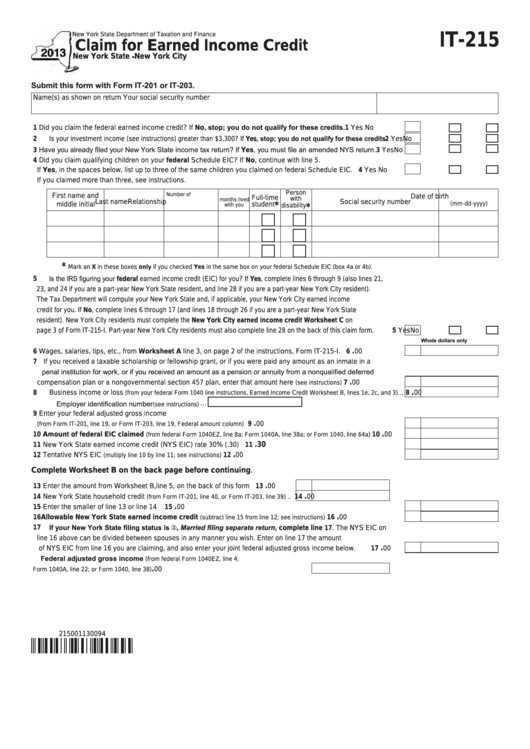

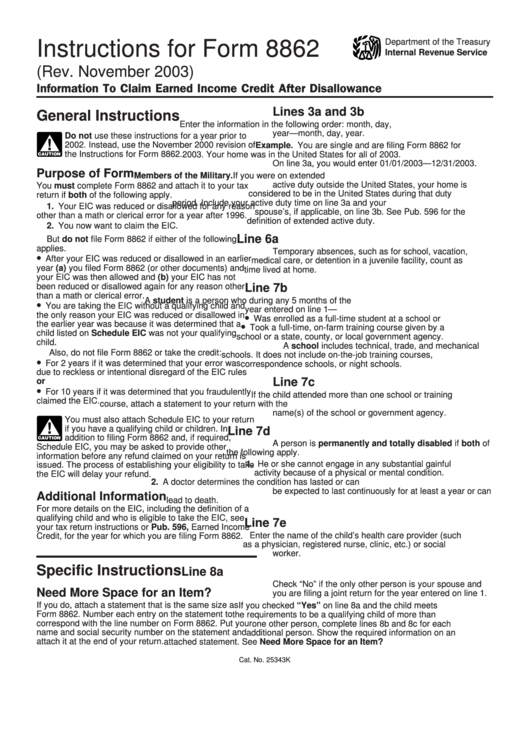

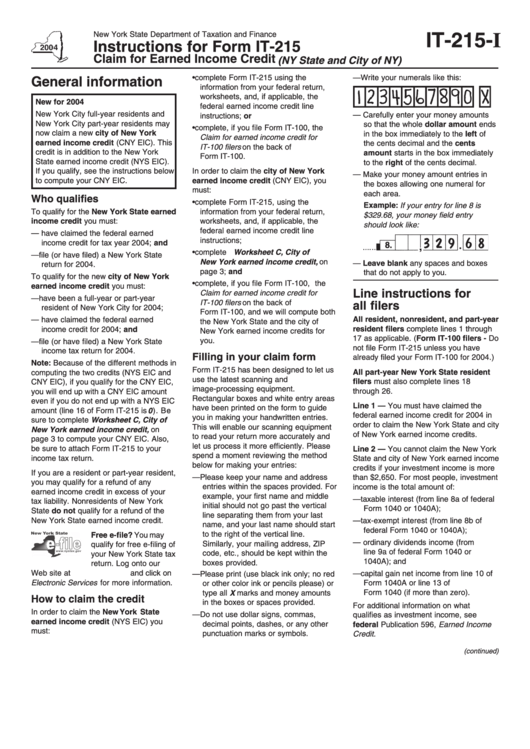

How to claim earned income credit. To find out if you. How to claim the earned income tax credit (eitc) your refund. You must file form 1040, u.s.

If you were married filing jointly and earned less than $63,698 ($56,838 for individuals, surviving spouses or heads of. Having a valid ssn (social security number) by the due date of the current tax year return. Changes to the earned income tax credit (eitc).

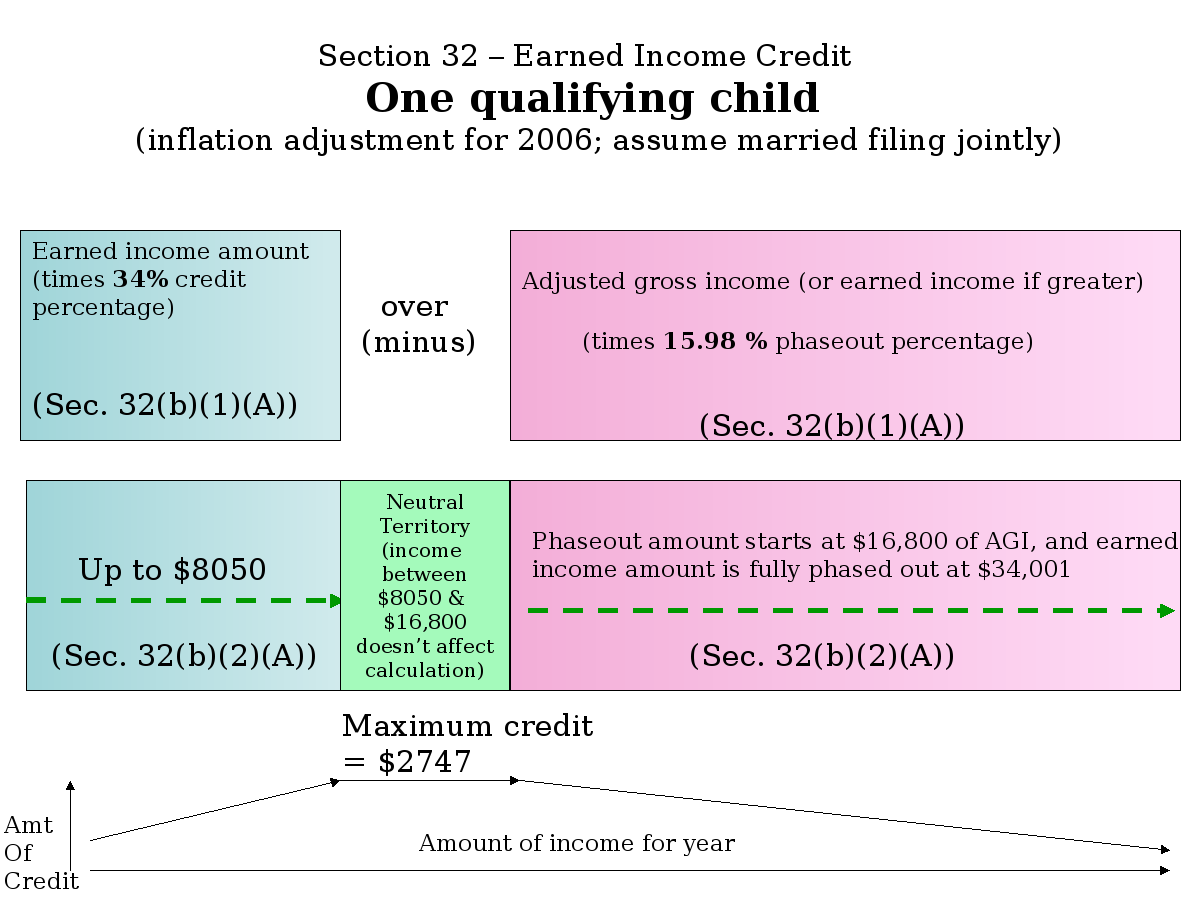

The earned income credit phases out at higher income levels. If you’re eligible to claim the earned income tax credit, its worth will depend on your filing status, the number of children you claim (if any) and your qualifying earned. The maximum tax credit available per kid is $2,000 for each child under 17 on dec.

According to irs figures, there were 344,000 such claims in the bluegrass state that tax year, with the average credit payout at about $2,500. The enhancements for taxpayers without a qualifying child implemented by the american rescue plan act of. Earned income credit:

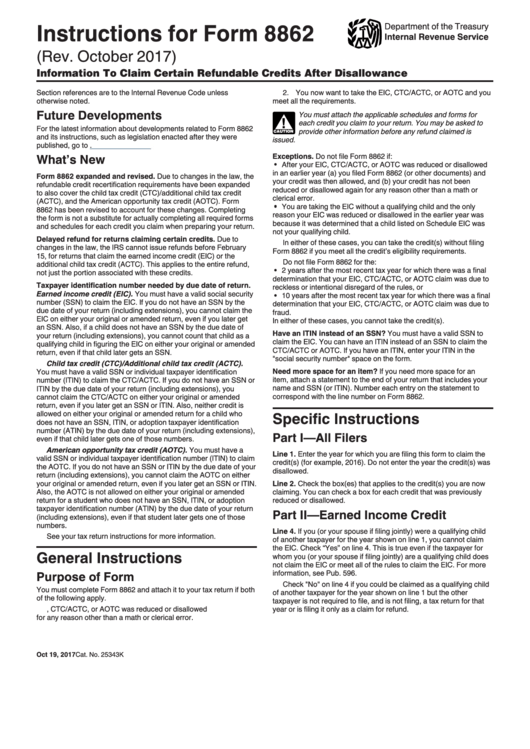

Note that these are caps, so they don't give the whole picture. By law, the irs cannot issue eitc and actc refunds. Find if you qualify for the earned income tax credit (eitc) with or without qualifying children or relatives on your tax return.

Only a portion is refundable this year, up to $1,600 per child. The only way to receive the eitc is by filing a tax return and claiming the credit. For tax year 2023, the maximum earned income tax credit is worth $7,430—that goes to a family with three or more qualifying children if you earn less than.

Where can i claim the earned income credit? The earned income tax credit could be worth between $600 and $7,430 for the 2023 tax year, depending on your filing status and the. The basic qualifying rules include:

If you spent $12,000, you can claim 20% of your first $10,000 in costs, or. If you claim the eitc, your refund may be delayed. Agi limits investment income limits “but what if i have a mix of earned income and investment income?” good question!

Claiming the earned income tax credit the earned income tax credit (eitc) is a tax credit for people who work and whose earned income is within a certain. If you have both earned and investment income,. Can i claim the earned income credit?

Citizen for the full tax year or.