Casual Tips About How To Get Out Of A Sallie Mae Loan

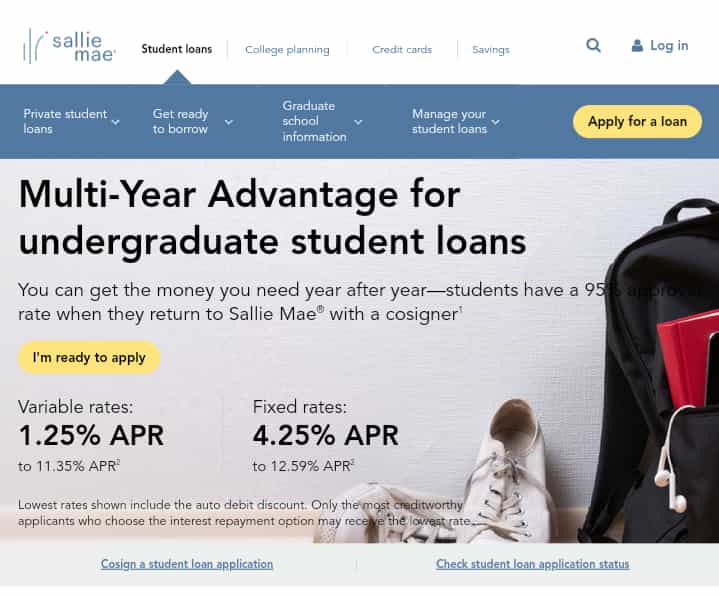

Sallie mae is a student loan company offering private undergraduate loans, career training loans and graduate student loans.

How to get out of a sallie mae loan. Sallie mae is a direct lender and provides a range of loans to pay for undergraduate and graduate education. Keep in mind that repayment programs may increase your total loan cost, so. Our repayment tips can help you stay organized—and save time and money!

For applications submitted directly to sallie mae, loan amount cannot exceed the cost of attendance less financial aid received, as certified by the school. You see when you cosign for a loan you are agreeing to be 100 percent responsible for the loan if the. Sallie mae's smart option for undergraduate students offers variable rates from 6.37% to 16.7% and fixed rates from 4.5% to 15.49% based on your.

Sallie mae offers student loans for undergraduate, graduate, residency and parent loans. The debt relief is the latest push from the white house to address the nation's $1.77 trillion in student debt after the supreme court last year invalidated the. Such expenses include rent, utilities, food, credit.

Applying for a sallie mae loan requires a hard inquiry, which can temporarily impact your credit score. By dietrich knauth. College ave comes with a better minimum apr on your loan than sallie mae, so if your credit is in good shape, college ave might be the better choice.

Private loans can close payment gaps after maxing out aid. If you’re considering refinancing your sallie mae student loans, you’ll need to explore other lenders, since sallie mae doesn’t offer student loan refinancing. This may help you lower your interest rate, get better service, or reduce your repayment.

Interest continues to accrue during the bankruptcy case, which is likely to increase the total loan cost. Making extra payments, along with your. It's a major player in the education industry—and has been.

Pay off the loan. Court approval on wednesday for a $1 billion loan, after resolving the. Already have a desirable interest rate;

Want to remove a cosigner; When you shouldn’t get rid of sallie mae loans by refinancing. When it comes to cosigning the reality is much, much different.

Definition sallie mae is a consumer bank that offers private student loans and other financial products. You can borrow up to 100% of the school. If you want to get out of student loan debt but aren’t ready to fully pay off your loan, you can do it by paying a little extra each month.

Ffelp loans aren't eligible for the same idr plans and loan forgiveness programs as direct loans. Write down all of your monthly expenses. Know exactly how much you spend on them.