Have A Tips About How To Keep Your Credit Score Good

Keep old credit cards open to maintain a long credit history.

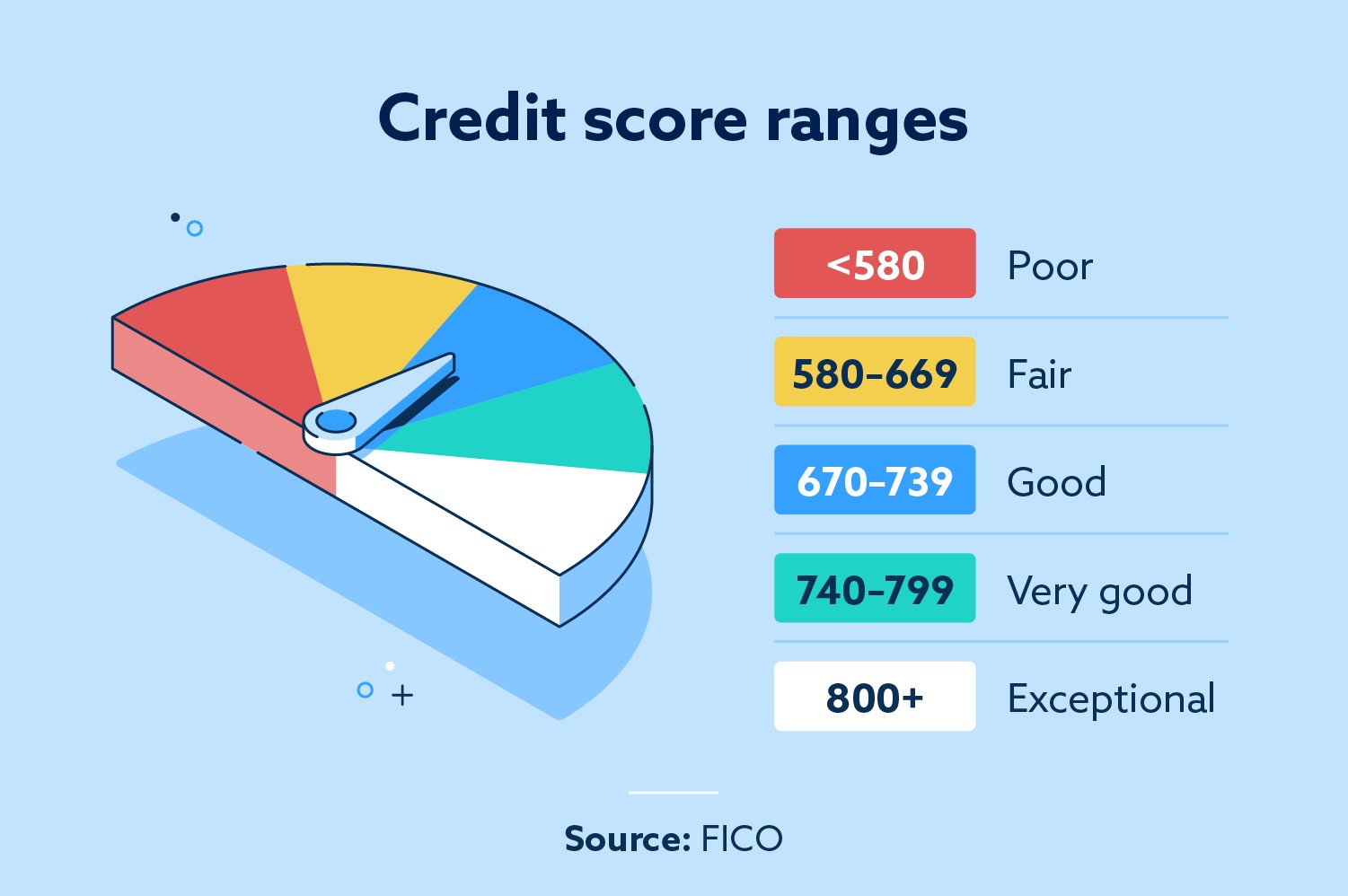

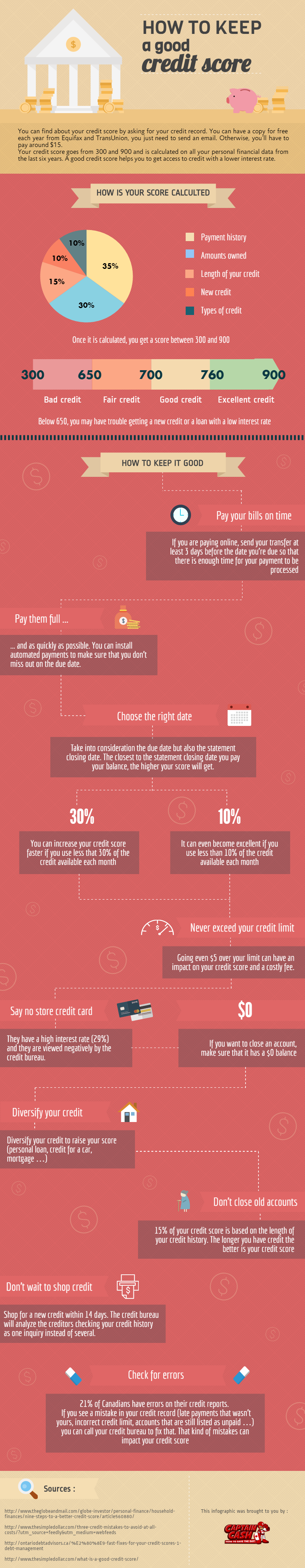

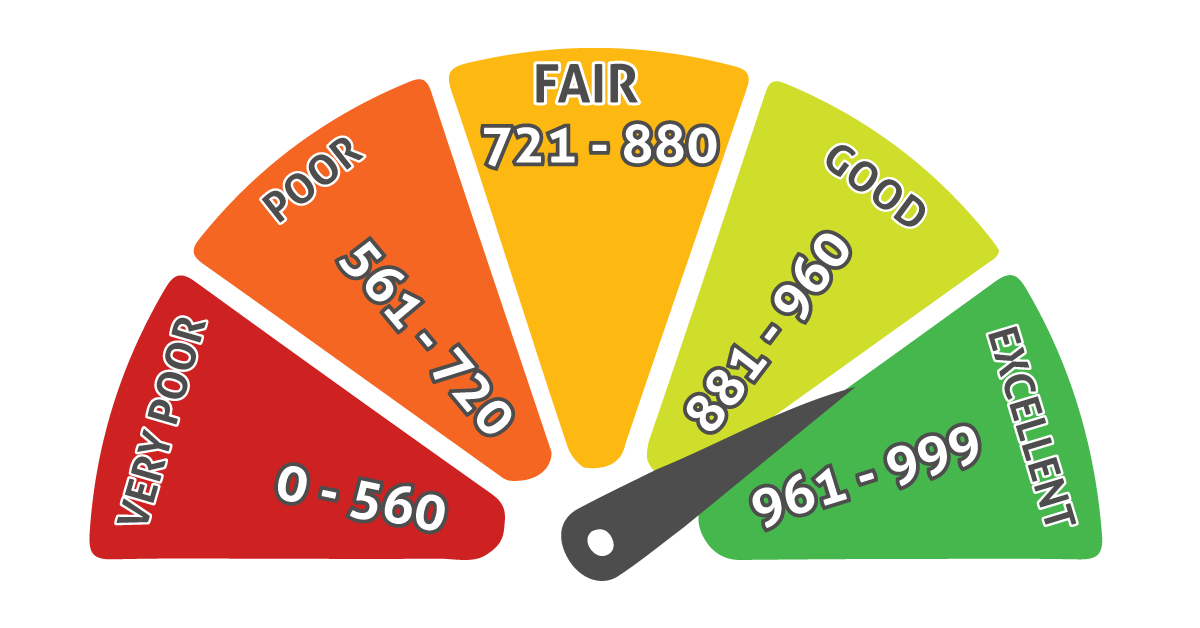

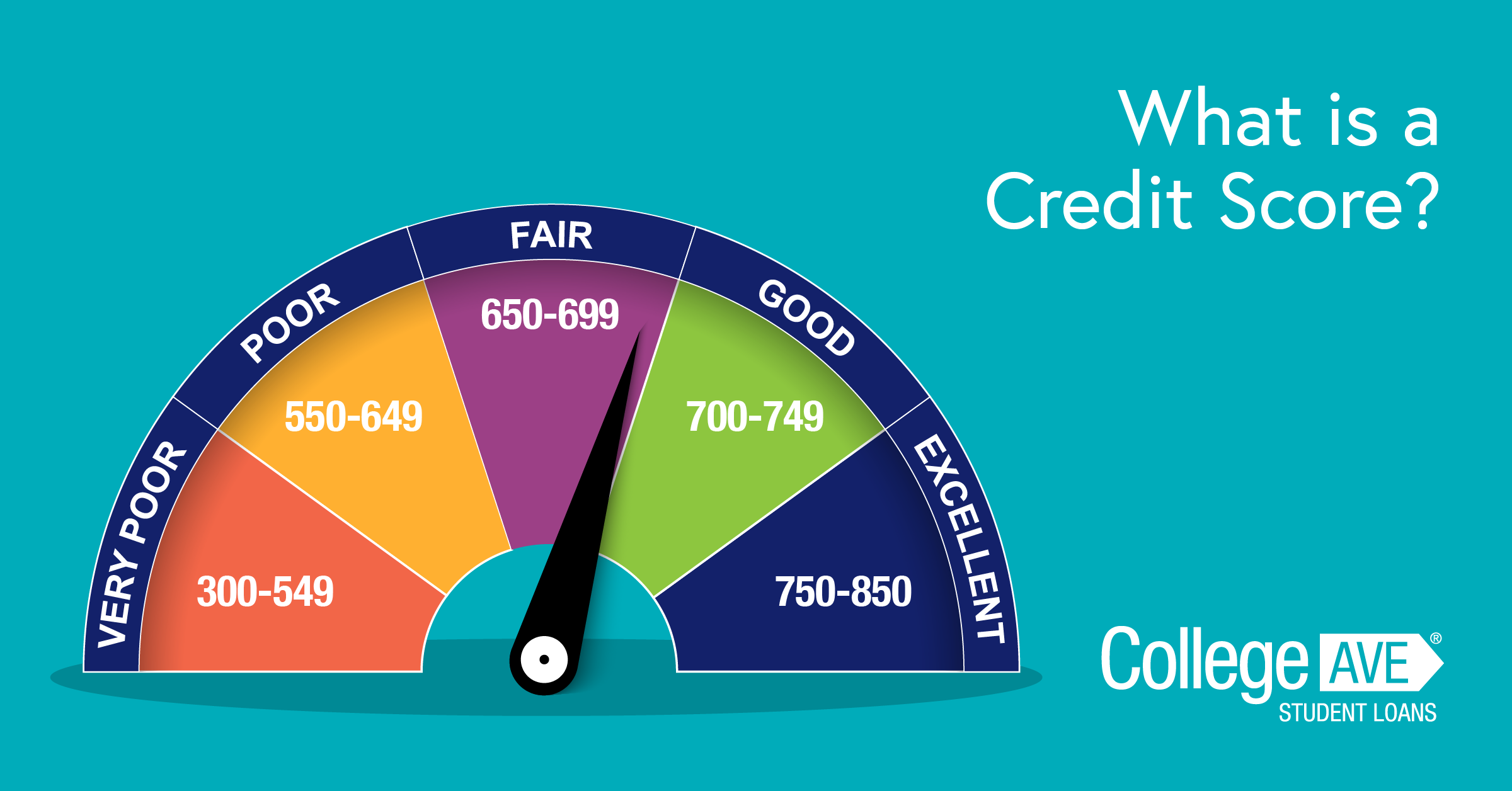

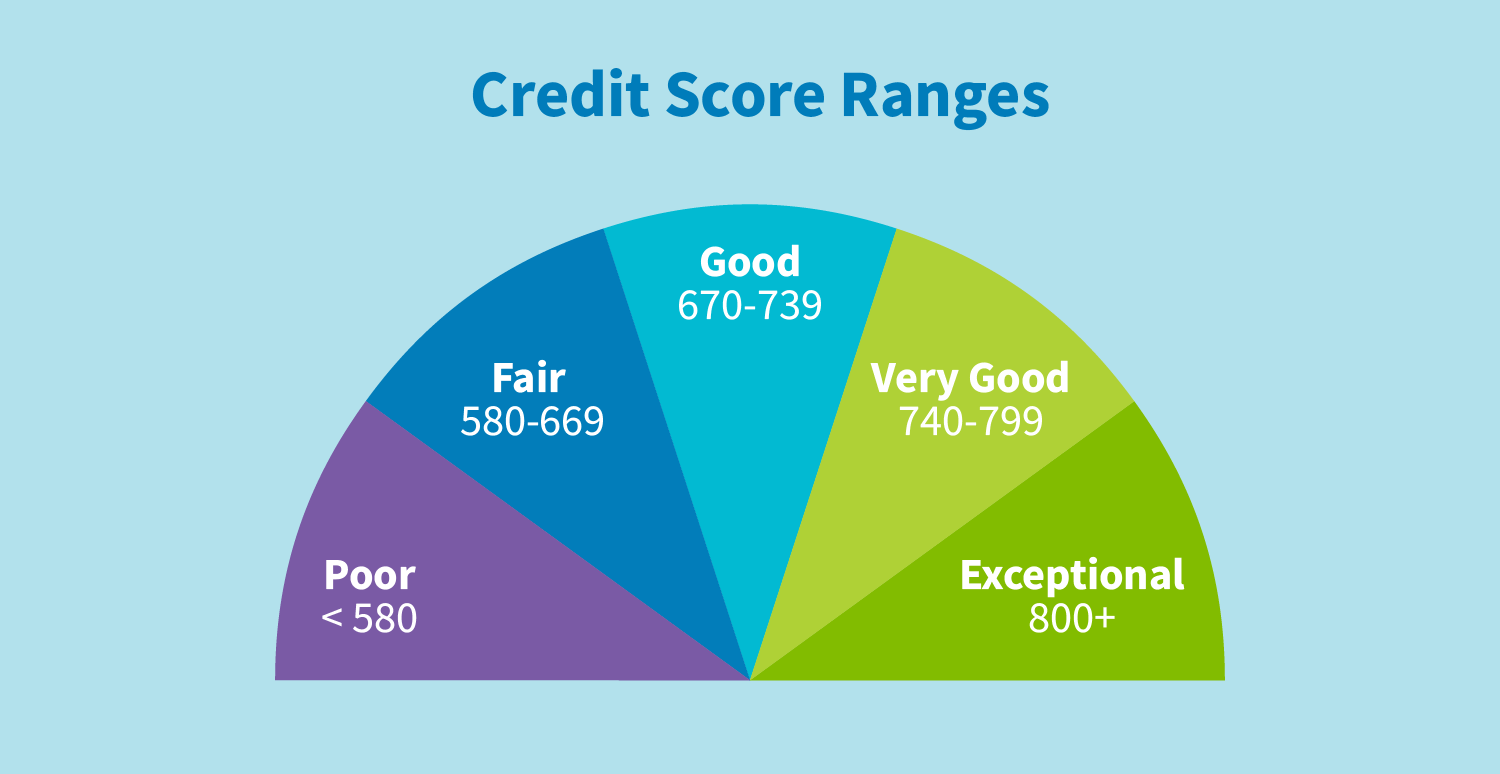

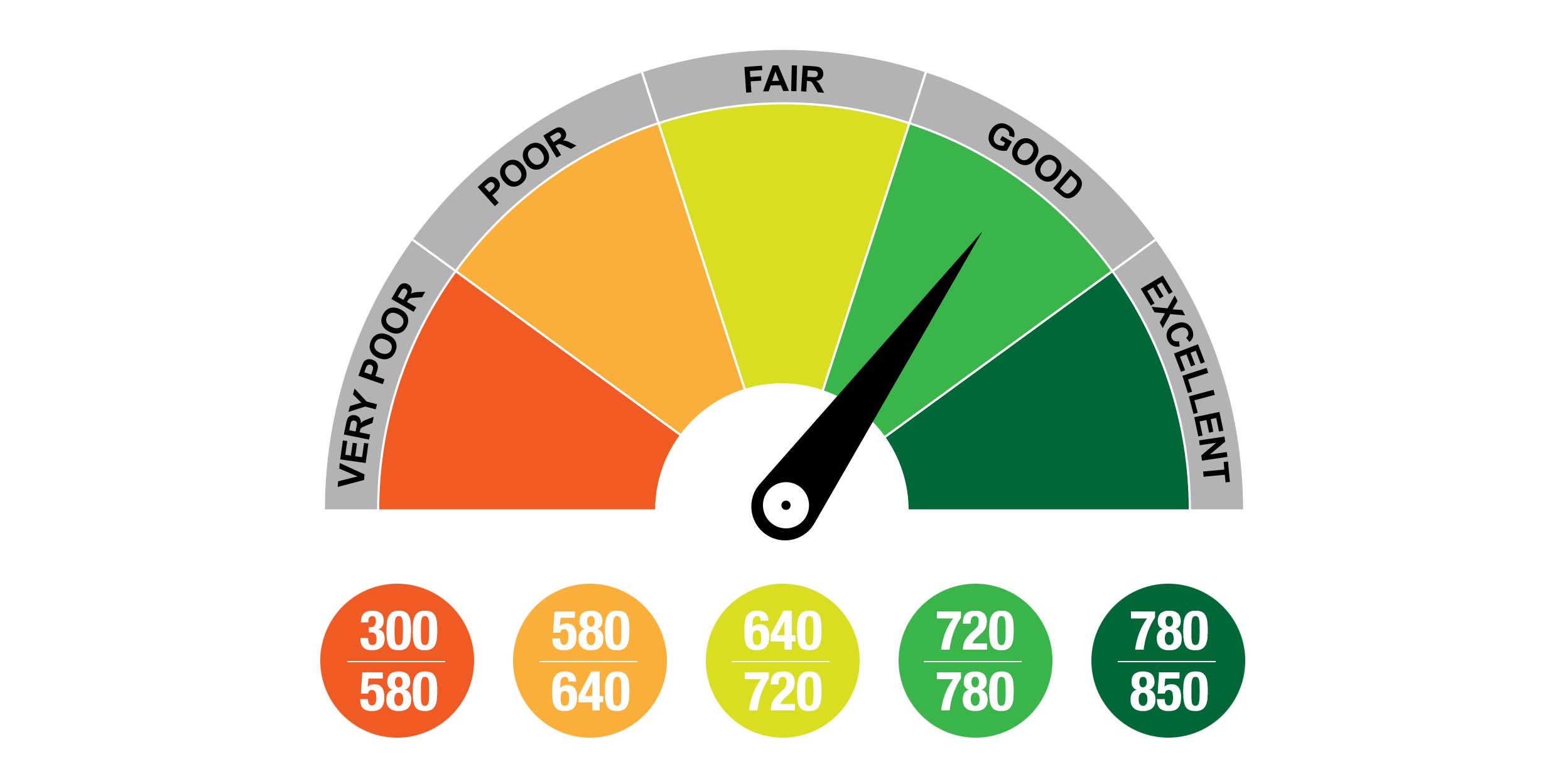

How to keep your credit score good. A good fico score is 670 to 739, according to the company's website. Here are the ranges experian defines as poor, fair, good, very good and exceptional. Pay your bills on time paying your credit card bills and other loans on time is important—especially since a history of late or missed payments can cause a dip in your credit scores.

One way to quickly increase your credit score is to review your credit report for any errors that could be negatively impacting you. It tells lenders at a glance how responsibly you use. It’s free to register, via the gov.uk website.

There is no secret formula to building a strong credit score, but there are some guidelines that can help. If your monthly credit card limit is $10,000, try keeping your monthly balance around $3,000. When you request your free credit reports from annualcreditreport.com, you only receive.

Treat all of your debts equally when it comes time to pay. Five key pieces of information are used to calculate your credit score—your. For example, if you have a credit limit of $2,000 and a balance of $500, your credit utilization ratio would be 25% ($500/$2,000);

You must have credit accounts and use them responsibly to build excellent credit. Your payment history makes up approximately 35% of your fico ® score, so making timely payments is an important way to improve your credit score. 14 helpful tips for maintaining a good credit score 1.

There are a few reasons why keeping credit cards open. Part 1 improving your credit score 1 review your credit score. If your credit reports have too little or no data, they can even be too thin to generate scores.

One way to make sure your payments are on time is to set up automatic payments, or. With the intelligence of ai, the most transformative technology of the century, users will receive more personalized insights and tailored health experiences through. According to these numbers, it’s easy to assume that a credit score above 670 is considered good.

Reap the rewards of all your hard work getting that score up—without causing it to drop back down. Stay below your credit limit In this new mobile era of ai, samsung is focused on remaining at the forefront of maximizing information.

If you close a credit card which had a $7,000 limit, you then lower your total available credit to $21,000 your credit utilization will go up to 33%. We’re broadcasting to you on e1, skar tv, ntn and tarzee tv in bartica. Here's how to build credit fast:

This is the news room for monday, february 26, 2024. Try to pay more than what’s due whenever possible. If you’re concerned about missing a due date, features like automatic bill pay can help you stay on top of your account payments.

![5 Ways To Keep Your Credit Reports Clean [Infographic] Credit card](https://i.pinimg.com/originals/cd/6e/40/cd6e409a316a17fd7808b9e4c5c31a63.png)

![How A Good Credit Score Can Help You [Infographic]](https://financialhighway.com/wp-content/uploads/2010/07/A_good_credit_score.jpg)