Peerless Tips About How To Minimize Amt Tax

Table of contents.

How to minimize amt tax. Using irs form 6251, start with taxable income (income after personal exemptions and standard or itemized deductions) and add back the various adjustments. Specify the exemption amount in dollars. Defer income or accelerate deductions to a year when you’re not subject to amt.

What is the alternative minimum tax (amt)? Under the tax law, certain tax benefits can significantly reduce a taxpayer's regular tax amount. It is paid in addition to ordinary income tax.

While draft legislation to implement these changes was included. Figure out your regular tax liability, which you can find in your tax return or on line 16 in your form. Here are key approaches:

Effective tax strategies to minimize your alternative minimum tax liability include evaluating the timing of exercising your incentive stock options, utilizing available. You can achieve this by applying the alternative minimum tax equation: 6 steps to calculate your alternative minimum tax (amt) step 1.

He will share strategies to help you proactively minimize your amt liability, maximize your tax savings, avoid unexpected financial setbacks, and ultimately keep. Key takeaways on how to reduce the amt: An alternative minimum tax (amt) is the minimum amount of tax that high earners must pay on their income.

One of the most effective ways to minimize your alternative minimum tax is to contribute the maximum amount to employer retirement plans. Here are six ways to do it: Enter your taxable income in dollars.

You can complete irs form 6251 by hand, use tax software programs or hire a professional tax preparer to determine if you owe the amt and, if so, calculate the. The 2023 budget proposed a number of changes to the individual alternative minimum tax (amt). Why does the amt exist?

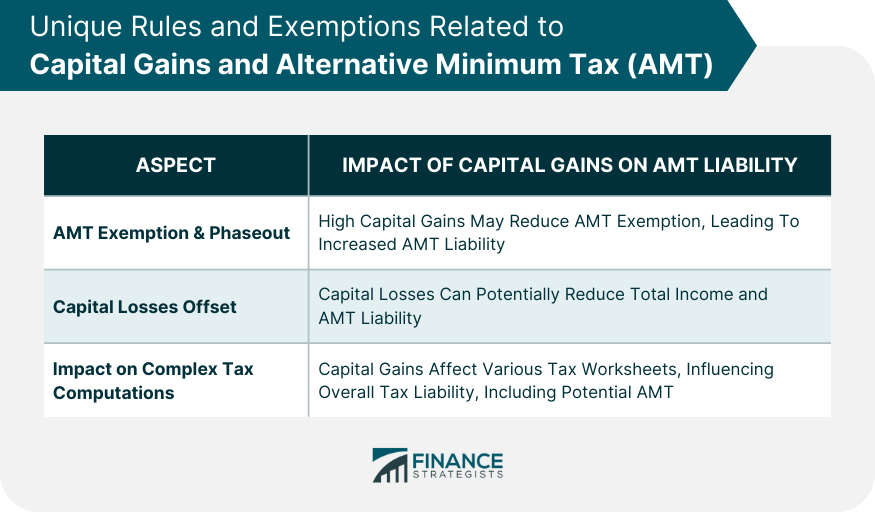

Capital gains can be a major trigger for the amt. Understand the amt rules and how they affect your tax liability. Table of contents.

Alternative minimum tax = (amti below threshold × 26% + any excess above threshold. The alternative minimum tax (amt) is a secondary way for canadians to calculate their income tax. Set the tax rate in percentage.

What are the 2023 and 2024 amt exemption amounts? Maximize retirement contributions. To use the amt calculator, follow these steps:

.png)