Neat Info About How To Obtain A Florida Sales Tax Number

Sales tax is handled by the florida department of revenue.

How to obtain a florida sales tax number. We recommend submitting the application via. 8.4k views 1 year ago sales tax compliance. Florida first adopted a general.

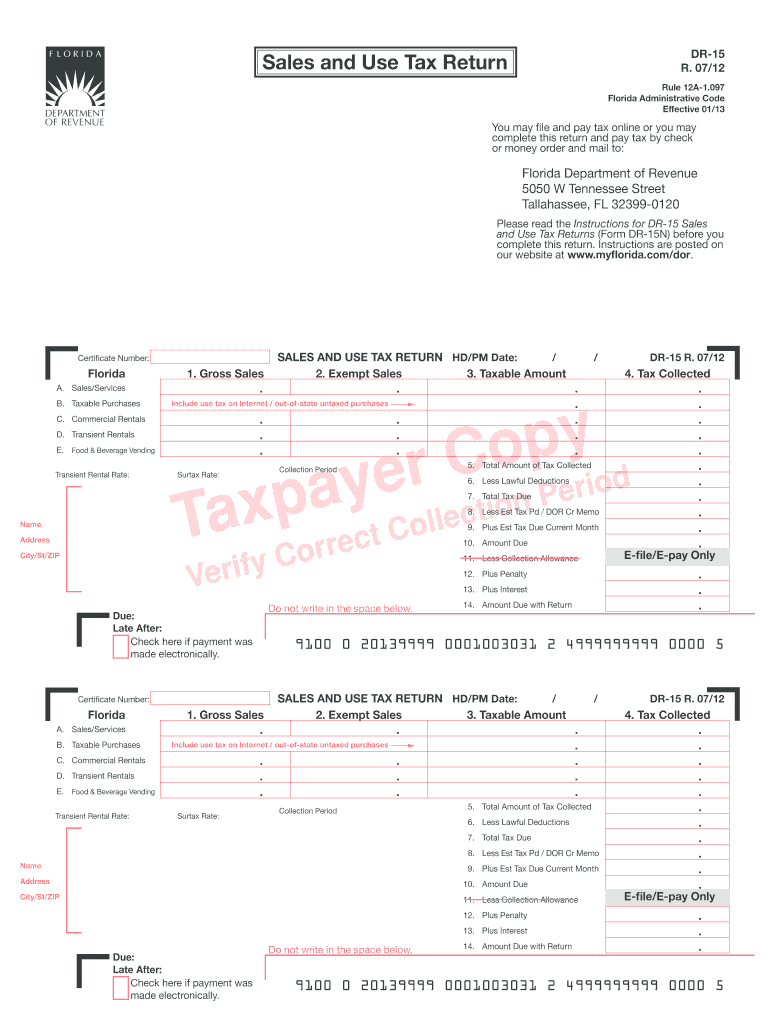

Each sale, admission, storage, or rental in florida is taxable, unless the transaction is exempt. Print out the certificate of resale from your florida sales tax account. Table of contents.

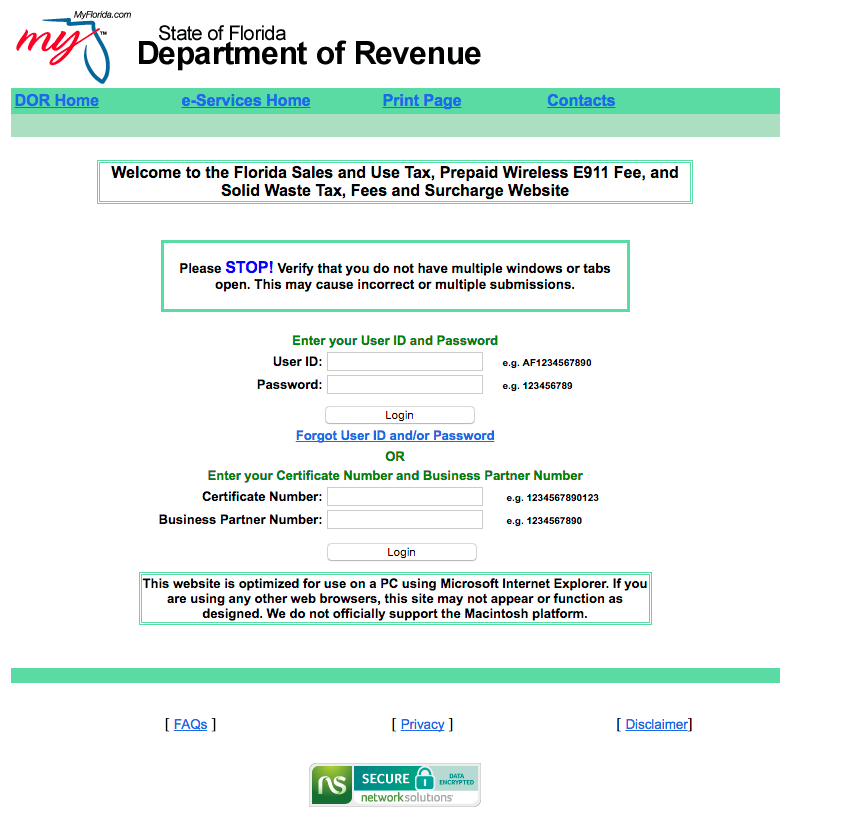

Businesses must collect tax every time they make a sale, charge admission to an event, or rent a home, room, or storage unit in florida. An ein number florida — also known as an employer identification number, federal tax. The certificate number and business partner number you provide for autofile should be associated with your florida sales and use tax account number.

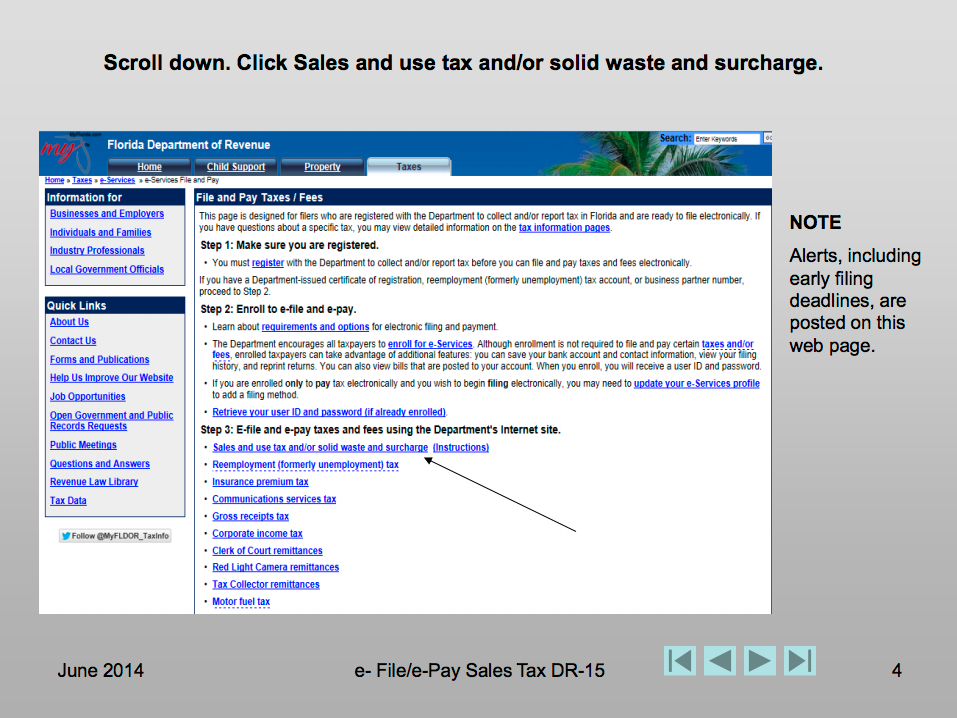

Identify what to register for. Sales tax is added to the price of taxable goods or services and collected from the purchaser at the time of sale. There are two ways to register for a sales tax permit in florida, either by paper application or via the online website.

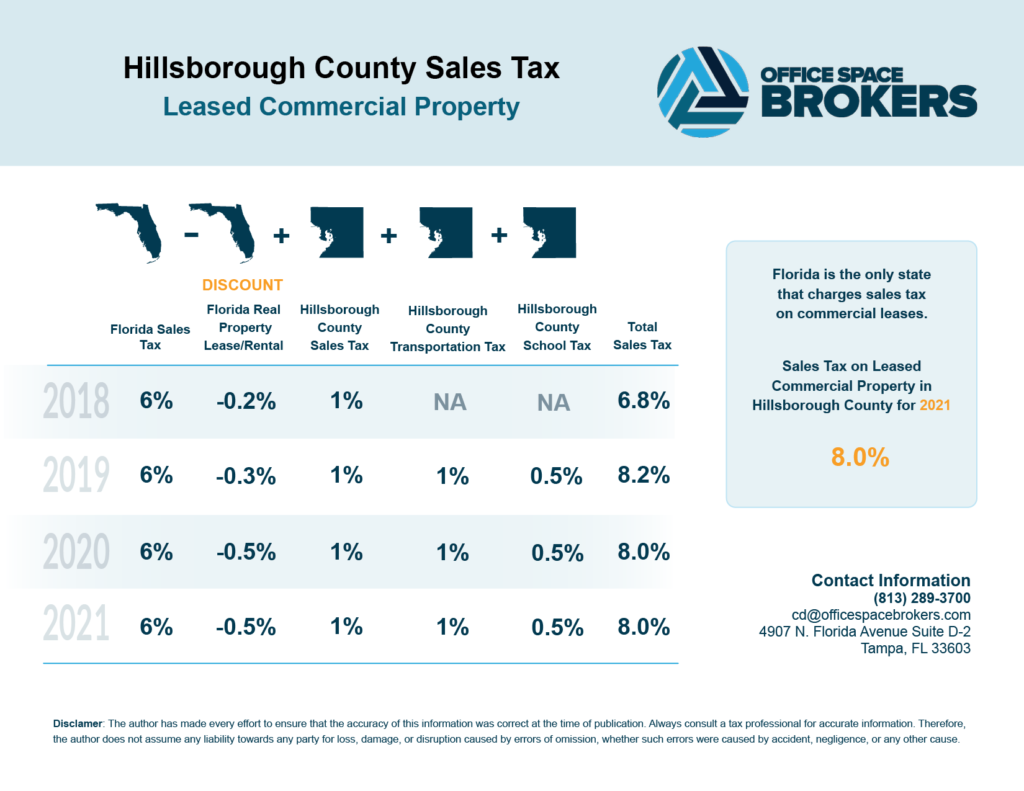

Visit the florida department of. To compute the total tax rate, add the state rate. If you've started a business and will be selling products or services in a state that charges sales tax, one of your first.

You might also need an. Tax calculation florida’s general sales tax rate is 6%. Sales tax is a tax paid to a governing body (state or local) for the sale of certain goods and services.

Complete a florida business registration. You can register to collect. Online sales tax can be a.

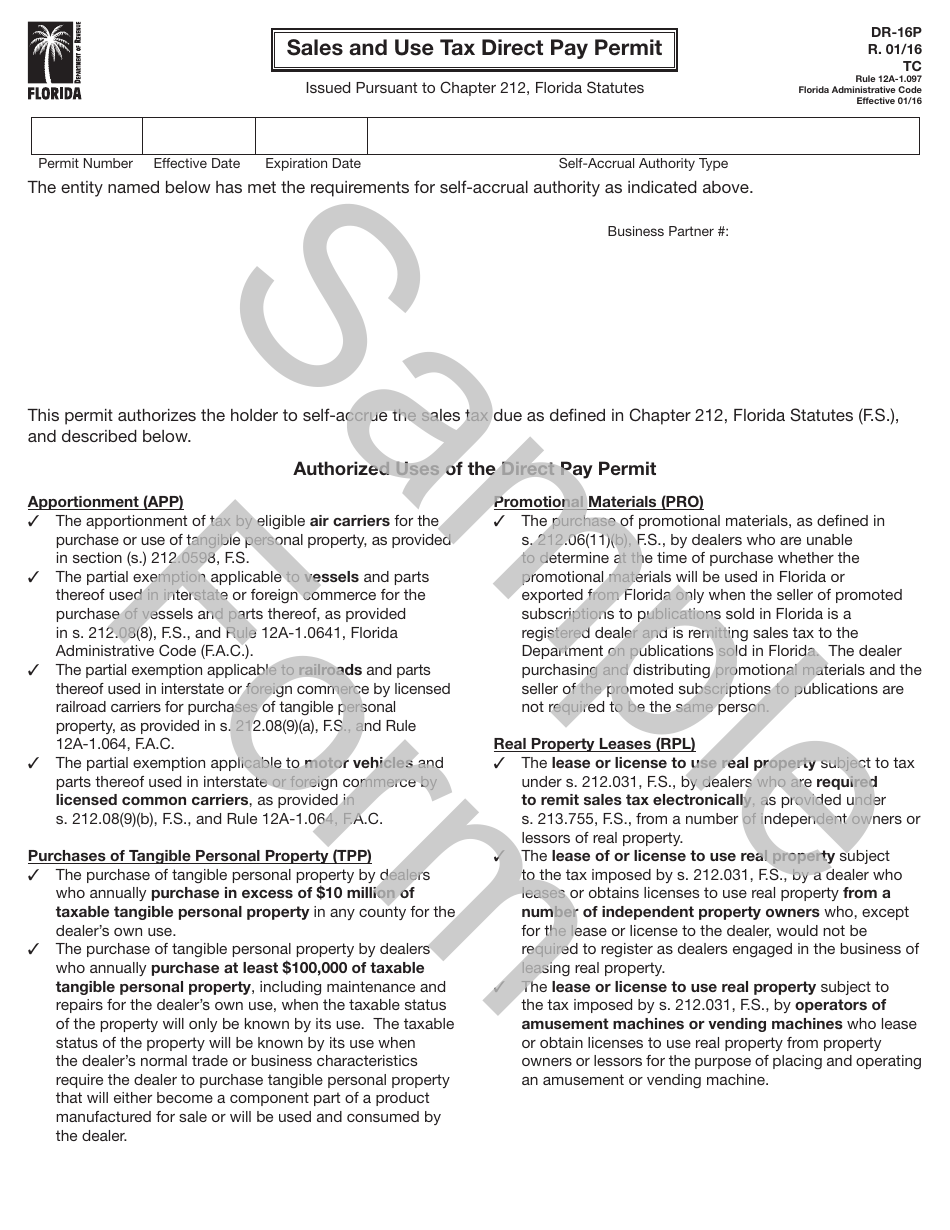

Apply for a sales tax certificate through the tax division of each state revenue department. You do not need to maintain a copy of your. If your business will have taxable transactions, you must register as a sales and use tax dealer before you conduct business in florida.

How to obtain a florida sales tax license. Everything you need to know. Florida's general state sales tax rate is.

Getting your state sales tax id number. Read chapter 1.