Impressive Tips About How To Pay Off High Interest Credit Cards

Negotiate a lower interest rate. if you noticed that your interest rate has increased (which will make it harder for you to pay off over time), you may be able to contact your credit card.

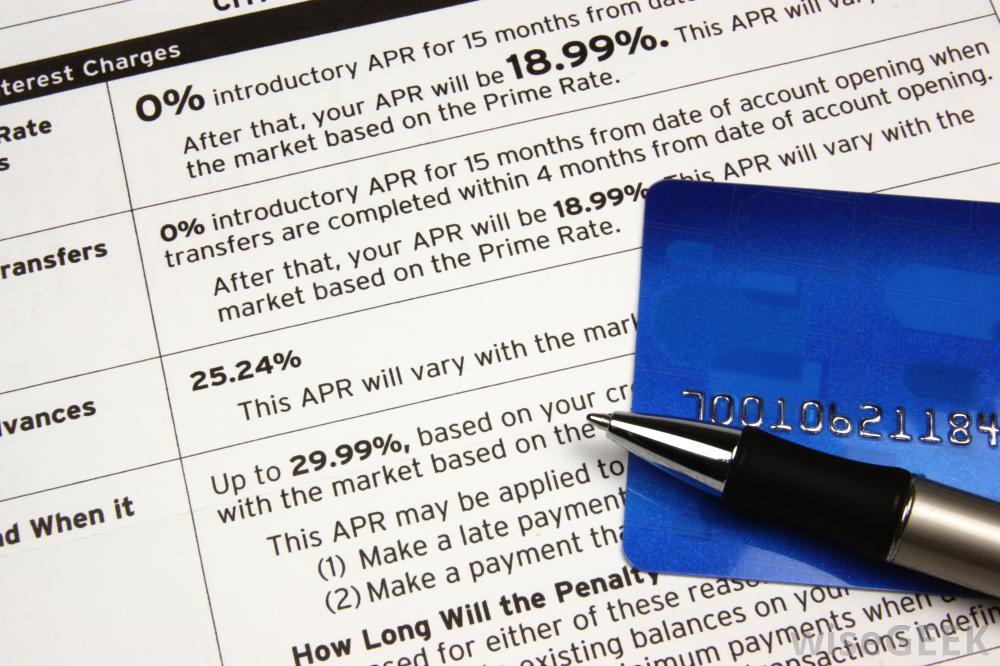

How to pay off high interest credit cards. Updated on july 12, 2021. 0% introductory apr on balance. If your minimum payment is 3%, you'll take a little over 25 years to pay off your balance.

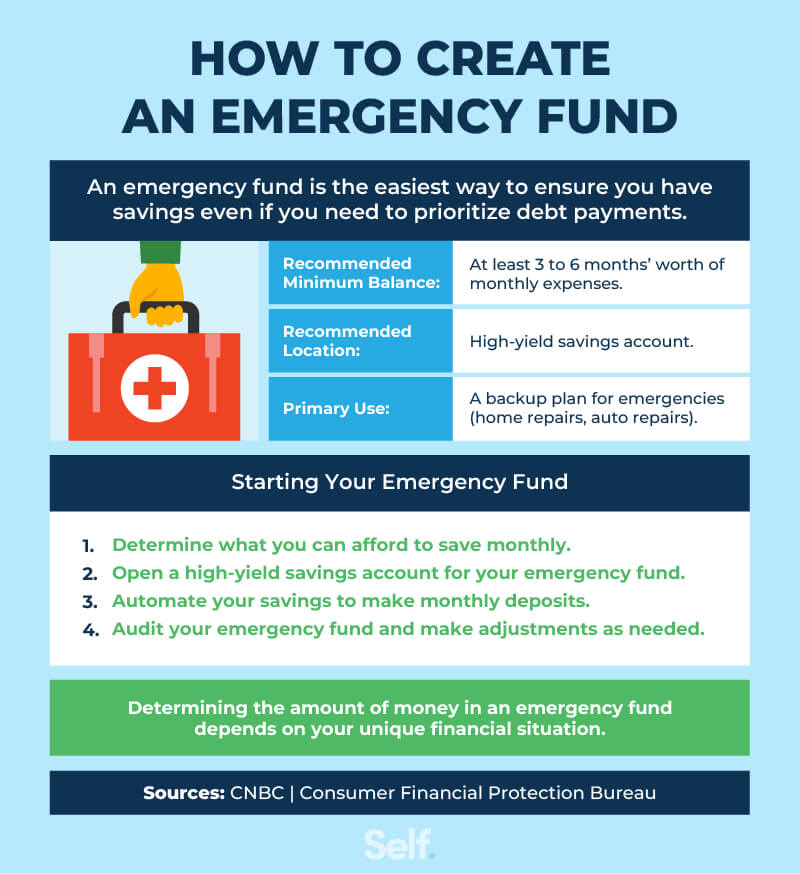

Paying off the smallest balance first. If you want to reduce the balance faster, but can't afford to substantially increase your monthly payments, try the following: Pay off credit cards or other high interest debt.

Delinquency rates on credit cards. An alternative to the avalanche method is the snowball method. Use cash or debit.

7 strategies for paying off high interest credit card debt. You can avoid crushing interest rates by. Using a balance transfer credit card.

Balance transfers must be completed within 120 days of account opening. The most effective way to pay off multiple credit cards is by paying a lump sum toward one of the debts and only the minimum on the other. If you pay off credit.

Assess your debt & make a plan. Know that to be successful in. The median interest rate for people with good credit — a score between 620 and 719 — was 28.20% on cards from from large issuers and 18.15% for small.

You’ll also decrease your debt faster since the interest fees will. This credit card payoff calculator also recommends. This is when you pay off your accounts starting with the.

Consider the snowball repayment method. One of the easiest ways to stop incurring credit card interest is to move your debt from your current card to one with a 0% apr offer for balance transfers. If you currently have credit card debt, moving it over to a balance transfer credit card will give you a long time to pay down your debt at 0% interest — typically a.

Use wallethub’s credit card payoff calculator to calculate how long it will take to pay off a balance and how much it will cost. No investment strategy pays off as well as, or with less risk than, eliminating high interest debt. 5%, with a $5 minimum.

Americans collectively hold $1.13 trillion in. Next, move to the account with the next highest interest rate and repeat the process until you pay off all of your credit card balances. If you only make the $35 minimum payment each month on a 22.74% apr credit card with a $1,000 balance, it will take you over three years (about 42 months) to.