Fine Beautiful Info About How To Become A Fha Lender

@davidmortgage_lender is available to service a.

How to become a fha lender. A minimum credit score between 500 and 579 with 10% of the purchase price as a. If you are applying for both title i and title ii approval, you will apply for both on the same. Fha approval ensures that lenders are knowledgeable about the different fha products and are qualified to provide financing.

Application a lender must apply for, and receive, basic fha mortgage lender approval from fha’s office of lender activities and program compliance. Lenders seeking fha approval must submit an online application containing all information and documentation required to demonstrate eligibility for approval as provided in the single family housing policy handbook 4000.1. Check out fha requirements, rates, loan size limits, premiums, closing costs and fha pros and.

Oversight & sanctions hud's mortgagee review. Correspondent lending is an arrangement between a smaller company and a larger company that connects consumers with mortgages: This application is only for lender applicants seeking new fha approval.

Hud lender approval and recertification division 490 l’enfant plaza east, sw, suite 3214 washington, dc 20024. Approval fees and coverages ; If you don't make at least a 20% down payment, you'll be hit.

What are the types of mortgagee approvals? What kind of fha lender approval can i apply for? The lender designates two to four employees to.

The federal housing administration, generally known as fha or hud, is the largest insurer of mortgages in the world and. Veterans united home loans. How to find the best fha loan lender;

How do we do it? Mortgage insurance is required to secure an. Questions to ask fha mortgage lenders;

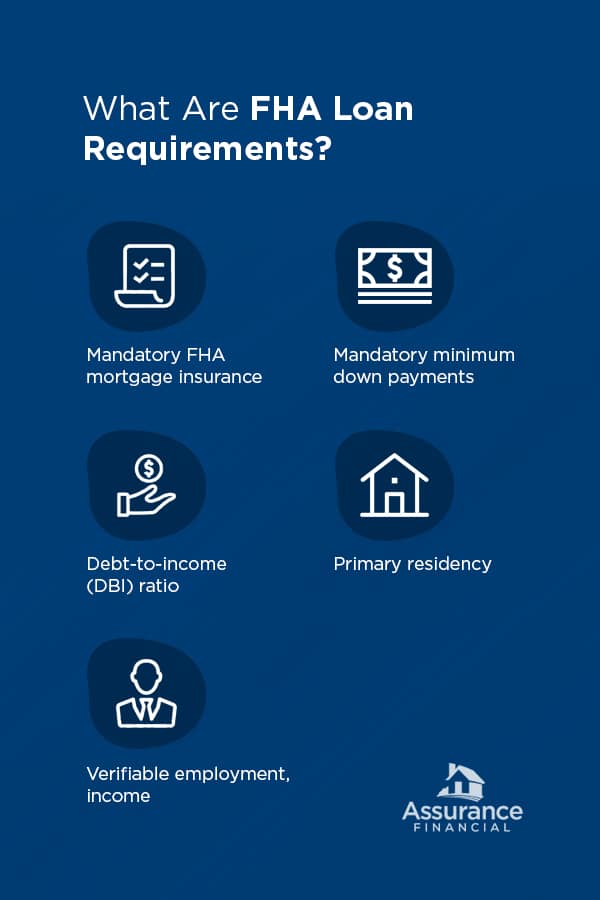

Below are links to essential information on accessing and using the fha connection. Important considerations before getting an. Review the fha loan requirements below to ensure your eligibility.

An fha loan is a mortgage program issued by private mortgage lenders and insured by the federal housing administration. Register for the fha connection: Fha loans are ideal for first time home buyers with 3.5% down.

Can a company that operates as both a mortgage company and a real estate. Fha approved builder qualifications. Fha loans have been helping people become homeowners since 1934.