Beautiful Work Tips About How To Claim Rrsp

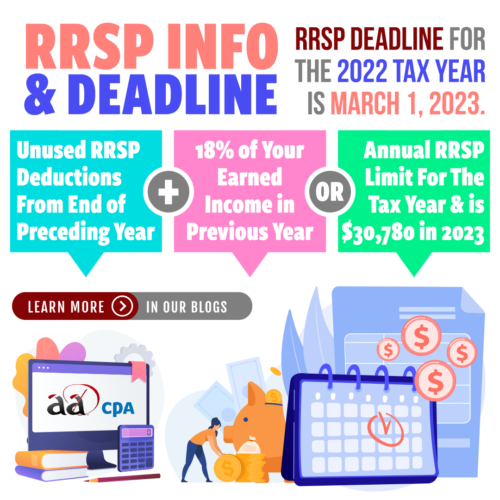

Start filing spousal rrsp contribution limits rrsp contribution limits are attached to you, not to your rrsp accounts.

How to claim rrsp. The contribution deadline for contributing to. This must be supported by. Your combined contributions to both your.

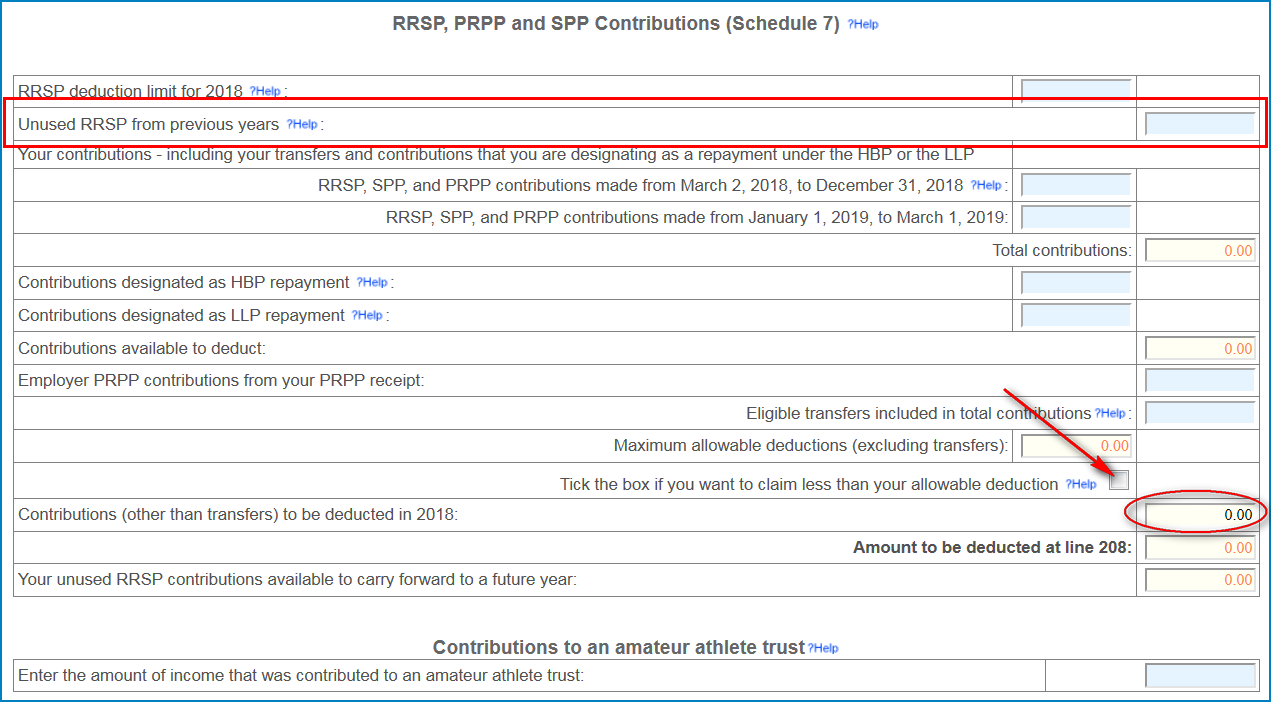

Unlike most deductions that you make throughout the tax year, rrsps are one of the few that aren’t tied to the calendar year. 0:00 intro0:10 steps for claiming a spousal rrsp in. You can claim allowable rrsp contributions as a deduction on your annual tax return to lower the amount of taxes you have to pay.

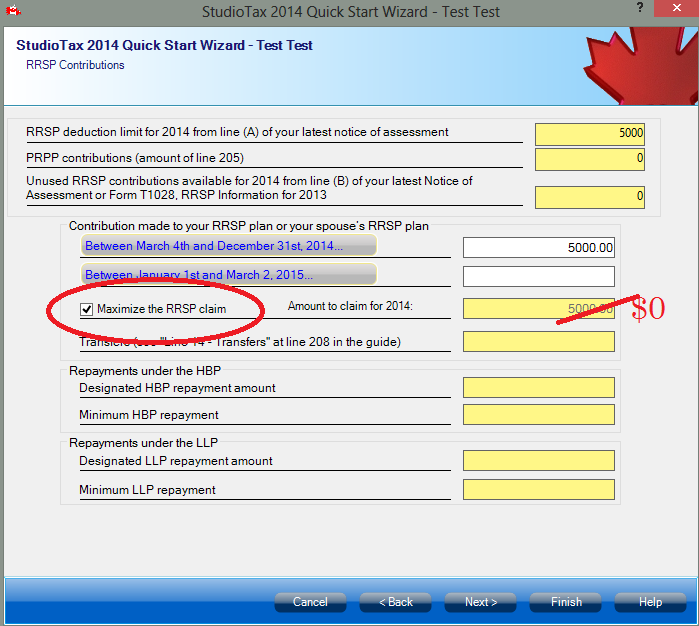

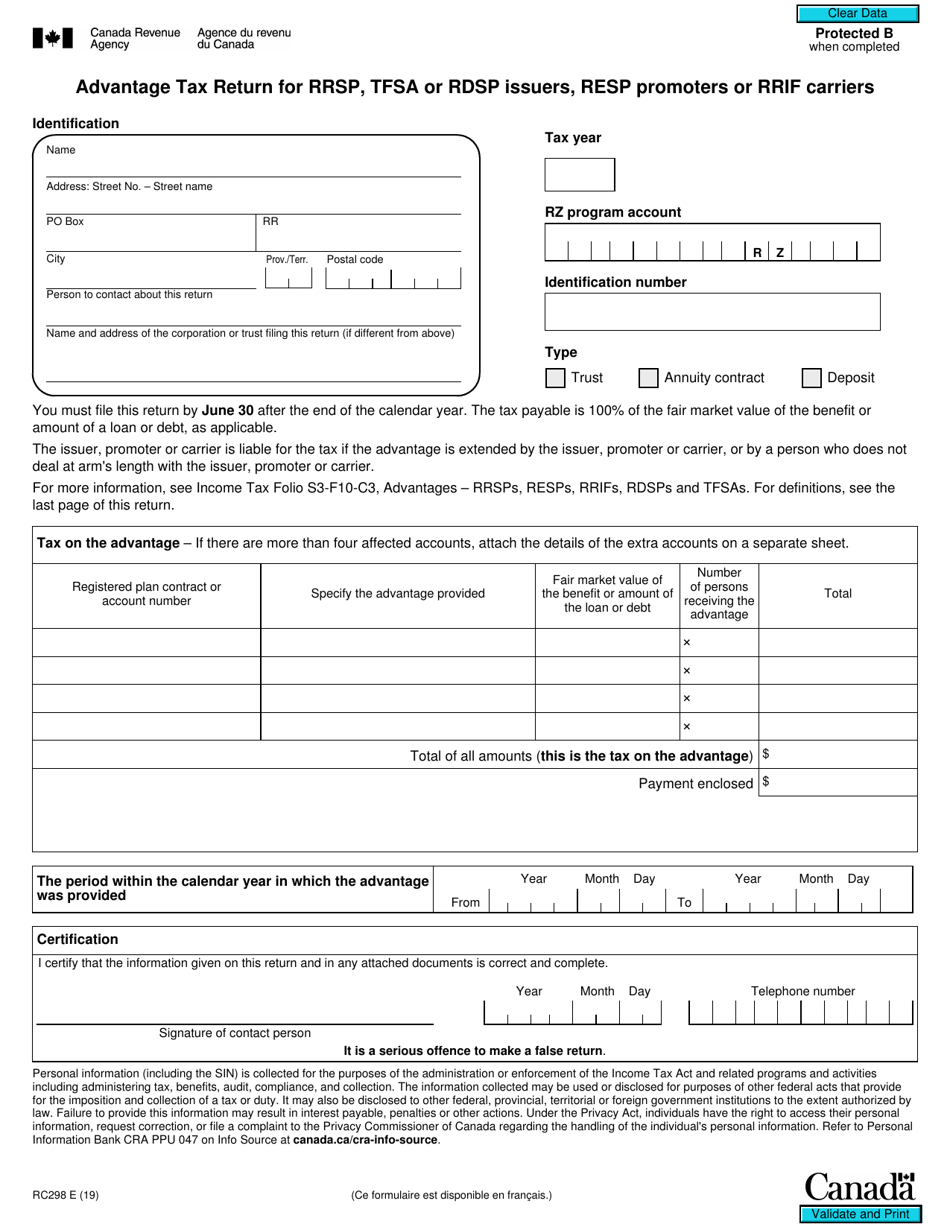

If the fair market value results in a loss, in order. There are some specific rules around withdrawals from spousal rrsps that you should know in addition to annual contribution limits. Contribute now, deduct later just because you make an rrsp contribution doesn’t mean that you have to claim it all at once, but your money.

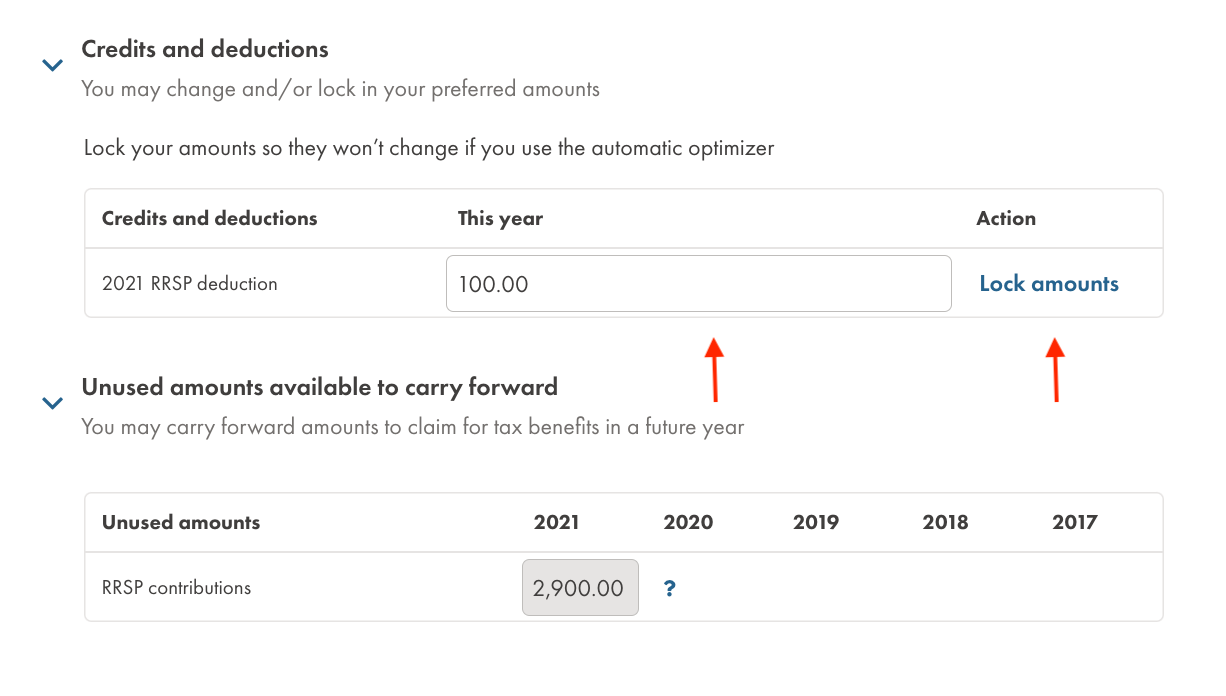

How does the contribution room. At tax time, you can claim a tax deduction for your. Registered retirement savings plan (rrsp) users can claim tax deductions for income year 2023 on contributions made on or before february 29, 2024.

A common misconception amongst canadian taxpayers is that you have to deduct all of the rrsp contributions you make each year. 1 minute read tax tip tax tip: A spousal rrsp allows a contributing spouse to claim a deduction for.

Learn how to add spousal rrsp on your taxes using turbotax online tax software. How to claim an rrsp deduction on income tax at the end of the year, your investment organization will add up all of your rrsp contributions. They will send you a.

Rrsp tax deduction carry forward rule. With these rules in place, many people no longer see the benefit of using spousal rrsps. Book an appointment benefits of contributing to an rrsp saving in an rrsp has a number of benefits.