Matchless Tips About How To Control Interest Rate Risk

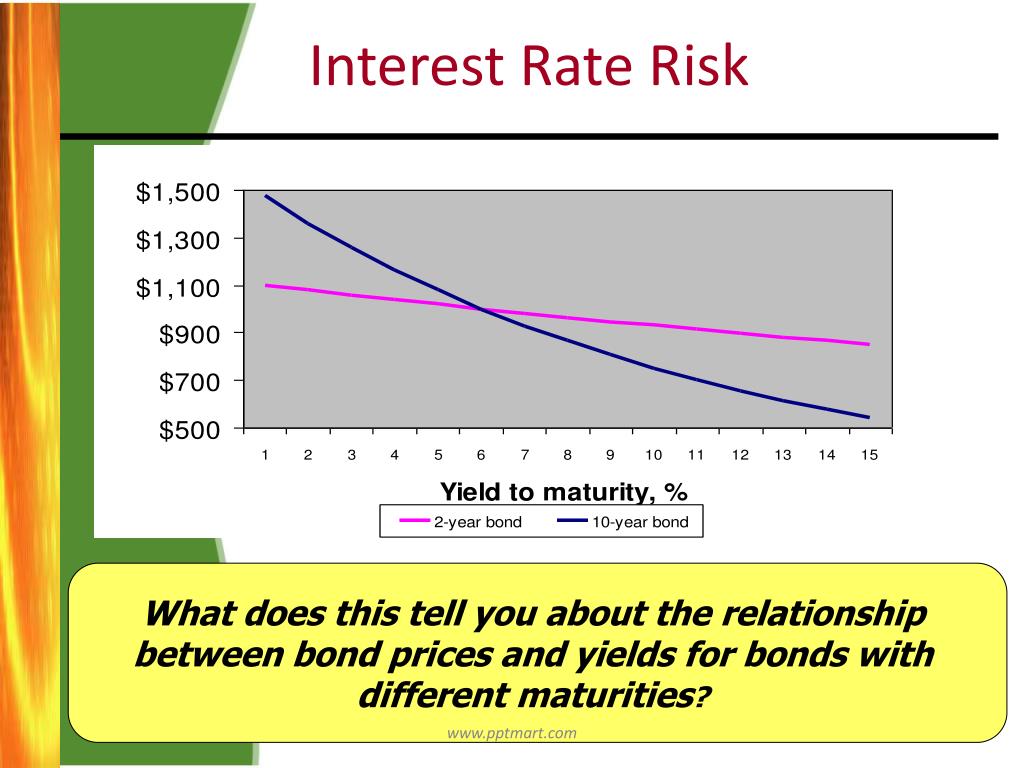

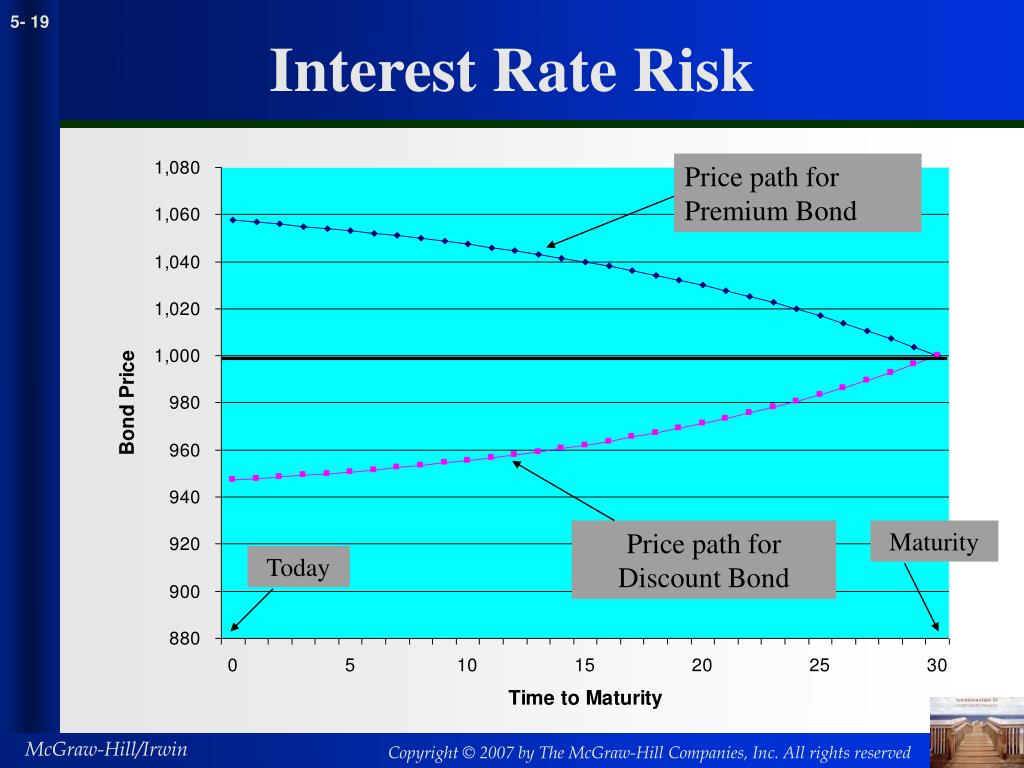

Interest rates and bond prices are inversely related.

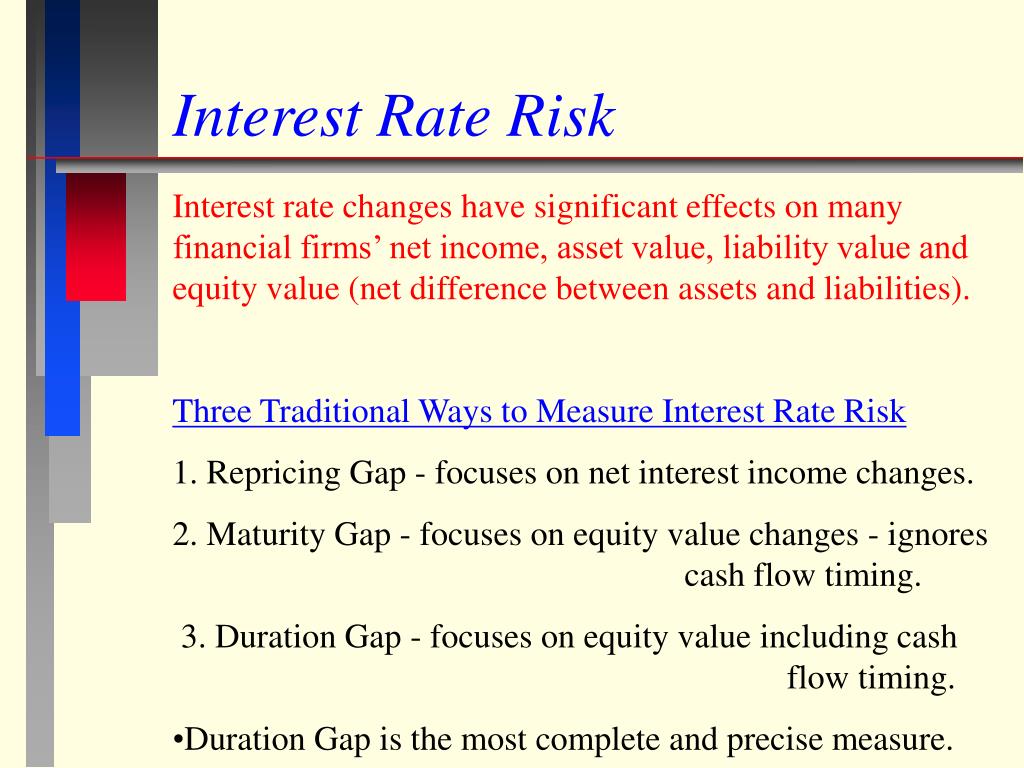

How to control interest rate risk. (a) discuss and apply traditional and basic methods of interest rate risk management, including: What is it and how do you manage it? Now that the initial shock has hit, bank directors are questioning how to manage interest rate risk better and prepare for disruptions.

Cfds can be used to help hedge against rising interest rates Shorten your portfolio’s duration—but not too much. The fed may wait too long to cut interest rates and spark a recession, economists say.

How to mitigate interest rate risk. Options on interest rate futures. Interest rate controls (ircs) and other financial repression policies are a commonly used strategy to keep down the cost of borrowing in support of economic activity.

Therefore, they carry a higher interest rate risk. The most common tools for interest rate mitigation include: Many banks were caught off guard by the rapid pace of interest rate hikes over the past year.

The fed typically cuts interest rates if the economy deteriorates sharply, pushing up unemployment, or if it’s clear that inflation is under control, no longer requiring rates to remain elevated. To quantify and manage risk, key metrics used include: Interest rate guarantees or irgs.

The volatility of this cost. As inflation gathered force in 2021 and 2022, the federal reserve. There are a large number of choices to be made in defining such a policy, and most companies formalise them in a risk management policy document.

Banks should clearly define the individuals and/or committees responsible for managing interest rate risk and should ensure that there is adequate separation of duties in key elements of the risk management process to avoid potential conflicts of interest. You can purchase futures contracts on bonds or interest rate futures. Refinancing risks around the timing of debt issuance.

Within this capital structure framework, the treasurer will seek to control: Most tools for hedging interest rate risk can be grouped into two categories: This lets you lock in your interest rate.

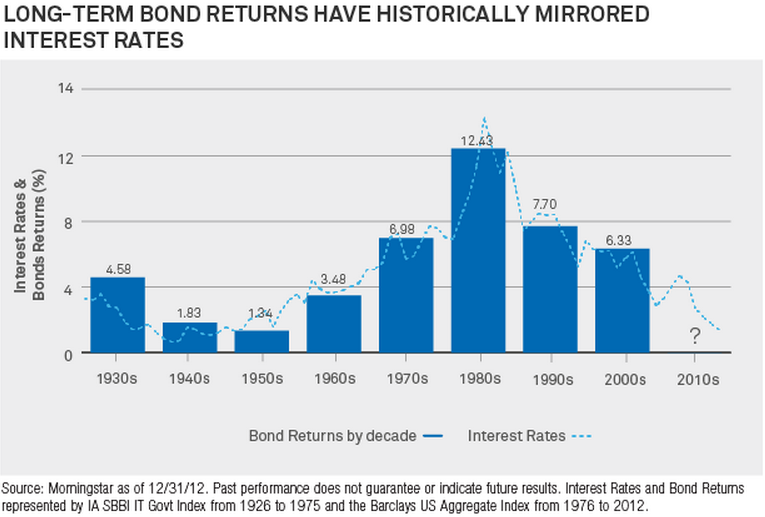

Shorten your portfolio’s duration—but not too much. This risk is a normal part of banking and can be an important source of profitability and shareholder value; Interest rate risk summed up.

Resources are available for evaluating and controlling interest rate risk. Interest rate risk is the exposure of a bank’s current or future earnings and capital to adverse changes in market rates. You can manage your exposure to interest rate risk by creating diversified portfolios and using hedging tools;